36%

of clients that complete a Business Valuation purchase Life Insurance

98%

owners don’t know

what their business is worth

40%

of business owners have no Life Insurance

80%

of business owners plan to fund retirement by selling their business

26+ years of experience in Business Planning Solutions

26+ years of experience in Business Planning Solutions

About us

Trust That You're Working with an experienced team of Advisors

Our vision at Platinum Business Solutions is to be the leading provider of innovative and comprehensive financial solutions that empower individuals and businesses to achieve lasting financial security and success. We aim to set the standard in the industry by delivering personalized, strategic, and results-driven services that protect assets, ensure continuity, and foster growth.

Platinum Business Solutions is dedicated to providing comprehensive financial planning to safeguard the financial security and stability of individuals and businesses. Our mission is to offer personalized solutions to concerns like income protection, estate planning, business protection, and exit planning. We empower our clients with strategic planning, risk management, and tailored financial solutions to ensure their long-term success, wealth preservation, and peace of mind.

At Platinum Business Solutions, our core values are centered around integrity, excellence, client-centricity, innovation, and collaboration. We are committed to upholding the highest standards of ethical conduct, delivering outstanding financial services, prioritizing our clients’ needs, embracing innovative solutions, and fostering a collaborative environment to achieve the best outcomes for our clients.

Business protection services are essential for safeguarding against risks and unforeseen events that could disrupt operations and even the livelihood of the business. These services include buy/sell agreements, business continuation plans, keyman insurance, and contingency plans to mitigate threats and ensure business continuity, protect your investment, reputation, and the bottom line.

Estate planning involves strategically arranging assets and affairs to ensure they align with an individual’s wishes after death or incapacitation. It includes drafting wills, establishing trusts, naming beneficiaries, and addressing tax implications to preserve wealth and eliminate conflicts among heirs.

Income protection services offer vital financial support to individuals unable to work due to illness, injury, or disability. These services provide regular income replacement, helping cover essential expenses like mortgage payments, utility bills, and medical costs, ensuring financial stability during income loss and aiding recovery.

Survivor income services provide financial support to beneficiaries or dependents after the death of an individual. These services ensure loved ones have the necessary financial resources to maintain their standard of living and cover expenses if the primary breadwinner passes away.

Supplemental retirement income services provide additional financial support beyond traditional savings, helping clients maintain their lifestyle in retirement. These services include diversified income streams and strategies to protect against inflation, ensuring stable and reliable income.

Exit planning ensures a smooth business transition, maximizing its value for a successful exit via sale, succession, or other means. It involves assessing the business’s state, identifying key value drivers, and enhancing its appeal to potential buyers. Also addressing personal and financial aspects like retirement and Financial Security

90%

of all U.S. business10%

of business ownershave a writtensuccession plan10

MILLION

business owners plan to sell or close over the next decade as a means to fund retirement

76%

of Baby Boomers are not confident that they have enough saved for retirementHow We Work

Platinum Business Solutions Working Process!

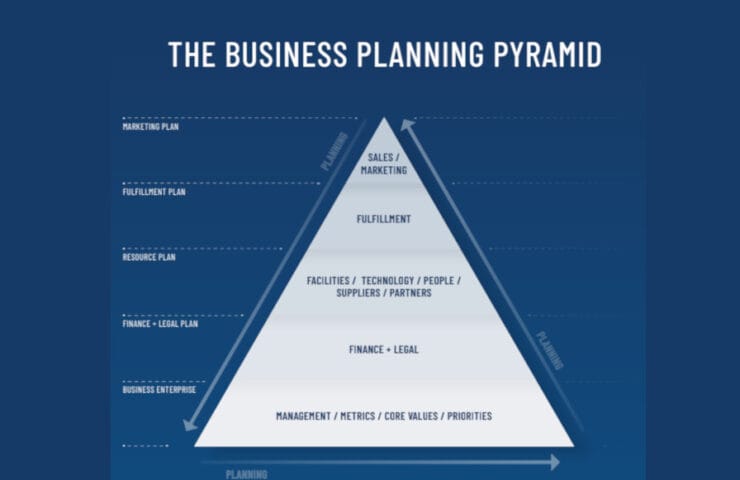

Business Assessment

Strategy Planning

Case Design

Strategies Implementation

Monitoring and Feedback

Things most Owners are not aware of

Numbers

6 business owners statistics according to the business owner readiness research

69%

of business owners have exit strategy on their priority list

75%

of business owners would like to exit their business within the next 10 years

49%

of business owners response want to exit within Five years

80%

of businesses are not marketable

In 10 years

business owners have gone from poor preparation and misinformation about the importance and impact of exit planning to improved readiness

73%

of business owners are baby boomers

Experience

Our Case Studies

Need Help?

Frequently Asked Questions

It’s natural to worry about whether the proceeds from selling your business will be sufficient to sustain your desired lifestyle. This fear can be particularly acute if your business has been your primary source of income and financial security.